property tax loans texas

Your local assessors office may offer delinquent property tax installment plans that may cost less than a property tax loan. Property Tax Funding has helped over 10000 residential and commercial property owners in Texas avoid costly interest fees and penalties charged by the tax assessor on past-due property taxes.

Texas Property Tax Exemptions Credit Karma Tax

Weve helped thousands of Texans avoid penalties collection fees and foreclosure by offering a fast and simple solution.

. Heres What You Need to Know About Property Tax Loans in Texas. Texas Tax Loans Property Tax Loans. Texas property tax loans involve property owners making an agreement with a lending company such as Tax Ease for that company to pay off their debts to the local taxing authority completely.

List of Texas property tax lenders by county. 100 - 4000. Property tax loan in texas.

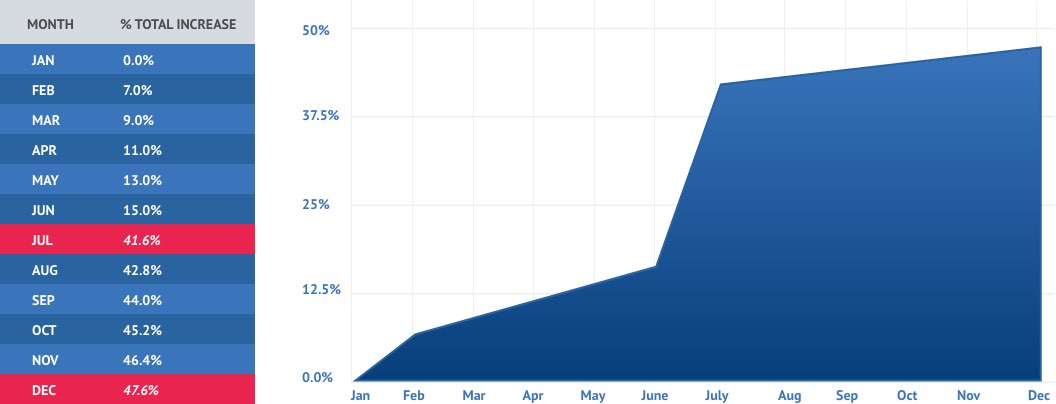

This interest and penalty rate will increase by 2 per month until July 1st when the authority will slam you with a staggering 20 collection fee. Property Tax Lenders Travis County TX. Property Tax Lenders Taylor County TX.

And 5 your date of birth. Dont let another month pass by while your delinquent property taxes continue to increase. Property Tax Lenders Cameron County TX.

2 - 13 Months. Texas property tax loans by Hunter-Kelsey are available to Texans who may be behind or unable to pay their residential and commercial property taxes. Are you looking into property tax loans in Texas.

We offer flexible terms and attractive rates to all property owners to pay your property taxes and penalties. With three base locations in Dallas Houston and McAllen TX we provide hassle-free Texas property tax loans for residential or commercial property owners. OCCCs Rules Title 7 Chapter 89 Texas Administrative Code.

4 the name of any mortgage company with a mortgage on the property. 3700 Riverwallk Drive 295. Copyright 2007 Texas Tax Loans.

These are the primary statutes and rules that apply to property tax lenders. Property Tax Lenders Potter County TX. Call us TODAY toll free for a no-obligation consultation with one of our tax loan professionals.

We are looking for a sales candidate that is highly motivated to exceed sales goals and perform with a can-do. What Are Texas Property Tax Loans. This is not a complete list of laws that property tax lenders are required to comply with.

One business Im particularly proud to have helped start is Propel Financial Services which provides property tax loans to home and business owners in Texas. Offer applies to loan amounts in excess of 15000. Save you time worry and money.

CALL US for help and a free quote. A property tax loan can not only stop the increasing county penalties interest and lawyer fees which can add up to 47 by the end of the first year of unpaid taxes but it can also. Property taxes often arrive at a time when you can least afford it - and it can easily seem like you could lose your home or business premises as a result.

Flower Mound TX 75028. We Pay Your Texas Property Taxes. Keep your property and your peace of mind.

A tax lien essentially is an interest in the property that vests the government with certain rights with respect to that property. We will pay your delinquent property taxes penalties and interest and provide you with a customized repayment plan that fits your budget. Send an application to 100 lenders.

Tax Liens and Personal Liability Chapter 351 Texas Finance Code. Here is some important information about property tax. Property Tax Lenders Harris County TX.

We help Texans pay their residential and commercial property taxes. Delinquent property taxes add up. No one should lose a home or business because of property taxes.

Give us a call now 800 688-7306. Were the leader in property tax loans having served thousands of Texans. Learn more about our property tax loans and get the property tax.

We understand that no two property owners are alike and are committed to finding solutions that work for each of our customers. While a tax lien is not quite an ownership interest in the property in that tax liens typically do not give the government an absolute right to dictate how a piece of property should be used tax liens nevertheless are a serious burden. SummaryThe Property Tax Loan Officer provides property tax financing to property owners with delinquent property taxes.

On 1 February of each year the taxing authority in Texas charges property owners 7 in interest and penalties in most counties. We pay your Texas property taxes so you can breathe again. 2 the property owners mailing address.

Since 2007 Propel Tax has made over 600M in property tax loans across Texas. In a property tax loan also known as. Property Tax Lenders Jefferson County TX.

It is where TribuTrust will help you pay off your property taxes penalties along with the interest to set you up with a customized. With property tax loans in Texas residential and commercial property owners can get rid of costly interest fees and penalties charges they otherwise have to bear by the local taxing authorities on the property tax. Texas Property Tax Loans - Johnson Starr.

And with our help no one has to. For a residential property tax loan please provide. This is an inbound sales position that requires adherence to operation hours and ability to achieve performance metrics.

Primary State Statute Chapter 32 Texas Tax Code. Apply online today or give us a call at 866-531-7678 for a free no-obligation consultation. Property Tax Lenders Tarrant County TX.

3 contact information for the property owner. Then the property owners pay back the lenders instead with both parties having agreed on the terms of repayment. We operate in every Texas county and can finance all types of real estate - residential commercial industrial and land.

When Texas residents find themselves in a pinch unable to pay their property taxes were the affordable solution they turn to for hassle-free low-interest loans. Contact Our Dallas Texas Property Tax Loan Specialists Today Apply Online or call to speak to a property tax loan specialist and get started today. 1 the property owners name.

Property Tax Lenders Collin County TX. A Hunter-Kelsey property tax loan helps you quickly pay your taxes so youll no longer incur the large penalties interest and attorney collection fees charged by your county. We are open 7 days a week 7 am to 7 pm.

Property Tax How To Calculate Local Considerations

Why Are Texas Property Taxes So High Home Tax Solutions

Texas Property Tax Loans 1 Property Tax Lender

Texas Property Tax Loans Funding Loans For Property Taxes

Texas Property Tax Loans Funding Loans For Property Taxes

Texas Property Tax Loans 1 Property Tax Lender

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Property Tax Loans Funding Loans For Property Taxes

Property Taxes 101 Understanding Your Property Tax Propel Tax

![]()

Texas Property Tax Loans 1 Property Tax Lender

Texas Property Tax Exemptions To Know Get Info About Payment Help Property Tax Exemptions In Texas Tax Ease

How To Protest Your Property Taxes In Texas Home Tax Solutions

Property Tax Relief Texas Property Tax Loans Home Tax Solutions

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

I Need Help Paying Property Taxes In Texas Home Tax Solutions

Property Owners Propel Financial Services

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease